You've likely noticed the confusion that often plagues different industries, leaving consumers frustrated and misinformed. It's essential to streamline communication and foster transparency to cut through the noise. By embracing clear messaging and advanced technologies, businesses can enhance user experiences, but how exactly can this be achieved across various sectors? The answer might just lie in understanding the nuances of each domain, and exploring the steps necessary to create a unified approach could change everything. What might that look like for your industry?

Overview of Domain-Specific Companies in the USA

Domain-specific companies play an essential role in the U.S. economy by providing specialized products and services tailored to niche markets.

These businesses span key sectors like healthcare, technology, finance, and manufacturing, each addressing unique customer needs and regulatory demands.

Definition and Importance of Domain-Specific Companies

In recent years, the landscape of American business has increasingly favored companies that focus on specific industries or niches. Domain-specific companies excel in providing tailored solutions, leveraging their expertise to meet unique market needs that broader companies often overlook. This specialization allows them to offer personalized services that resonate with consumers seeking greater expertise.

The rise of these niche businesses is fueled by a growing demand for customized products and services, especially in sectors like healthcare, finance, and technology. A 2021 report revealed that 70% of consumers prefer working with niche businesses due to their superior understanding of specific market dynamics. By concentrating on particular areas, domain-specific companies can innovate and differentiate themselves, enhancing their value propositions.

Moreover, these companies often harness advanced technologies and data analytics, which improve their operational efficiency and customer satisfaction. As the competitive landscape evolves, the significance of domain-specific companies becomes even more pronounced.

They not only drive innovation but also contribute considerably to economic growth, reinforcing their role as essential players in the modern marketplace.

Key Sectors Dominating the Market

Several key sectors are shaping the landscape of domain-specific companies in the United States, each demonstrating distinct characteristics and contributions to the economy.

The technology sector stands out with powerhouses like Apple, Microsoft, and Google, collectively generating over $1 trillion in annual revenue. This sector not only drives innovation but also influences various industries, setting trends that reshape consumer experiences.

E-commerce has also exploded, with Amazon capturing nearly 40% of all online sales in the U.S. This growth notably alters retail strategies, pushing traditional businesses to adapt or fall behind. The rapid rise of e-commerce reflects changing consumer preferences and the increasing importance of digital platforms.

Lastly, the financial services sector, led by firms such as JPMorgan Chase and Bank of America, manages over $20 trillion in assets, playing an essential role in shaping investment strategies and economic stability.

Each of these sectors—technology, e-commerce, and financial services—highlights the dynamic interplay of innovation, consumer behavior, and economic strategy, illustrating how domain-specific companies are vital to the U.S. economy's ongoing evolution.

Benefits of Specialization in Business Domains

The rise of specialization among U.S. companies highlights a strategic shift that has profound implications for market dynamics. As over 70% of businesses in technology and healthcare zero in on niche markets, they take advantage of focused expertise to enhance customer service.

This specialization fosters efficiency, allowing firms to create content and solutions tailored to specific needs, resulting in a notable 30% reduction in time-to-market for new products and services.

Moreover, specialized companies enjoy higher customer loyalty. Research shows that 67% of consumers are more inclined to return to brands that exhibit deep knowledge in their domain.

This loyalty not only strengthens brand messaging but also leads to increased profitability; specialized firms have seen a 15% rise in industry profits as they can command premium pricing for expert offerings.

The trend has also sparked economic growth, with the emergence of over 2 million new jobs in niche sectors.

Clearly, specialization isn't just a tactical decision—it's a transformative strategy that drives efficiency, loyalty, and economic impact, reshaping the landscape of American business.

Pharma Domain Companies in USA

When you look at the pharmaceutical landscape in the USA, several key factors shape its current state.

You'll find that leading companies, innovative breakthroughs, and ongoing challenges greatly impact the market dynamics.

Here's a brief overview to reflect on:

- Leading Pharma Companies

- Innovations in the Pharmaceutical Sector

- Current Challenges Facing Pharma Companies

- Regulatory Environment and Its Impact

Leading Pharma Companies

With over $500 billion in annual revenue, the U.S. pharmaceutical industry is dominated by key players like Pfizer, Johnson & Johnson, and Merck, which collectively shape market dynamics. These leading companies not only account for a significant share of the market but also drive innovation through substantial R&D spending.

In fact, the average R&D expenditure in this sector hovers around 20% of total revenue, demonstrating a commitment to developing new therapies.

In 2022, the top 10 pharmaceutical companies represented approximately 40% of the global market share, highlighting the concentration of power within the industry. The FDA's regulatory framework guarantees that safety and efficacy are prioritized, illustrated by over 4,500 drug applications submitted in 2022 alone.

This regulatory rigor reflects the industry's dedication to compliance while fostering innovation.

The landscape is also evolving with the rise of biologics and personalized medicine. By 2025, biologics are projected to account for 50% of drug approvals, underscoring the industry's shift towards targeted treatments.

As you navigate the pharmaceutical industry, understanding these leading companies and their strategies will provide valuable insights into the market's future.

Innovations in the Pharmaceutical Sector

Harnessing digital advancements, the pharmaceutical sector in the USA is undergoing a transformative shift that enhances drug development and patient care. With 75% of companies investing in digital innovations like advanced analytics and artificial intelligence, the efficiency of drug discovery is notably improved, leading to better patient outcomes.

Telemedicine has also gained traction, with 83% of healthcare providers adopting telehealth services post-pandemic. This integration has expanded access to pharmaceutical consultations, enabling patients to receive timely advice and treatment options from the comfort of their homes.

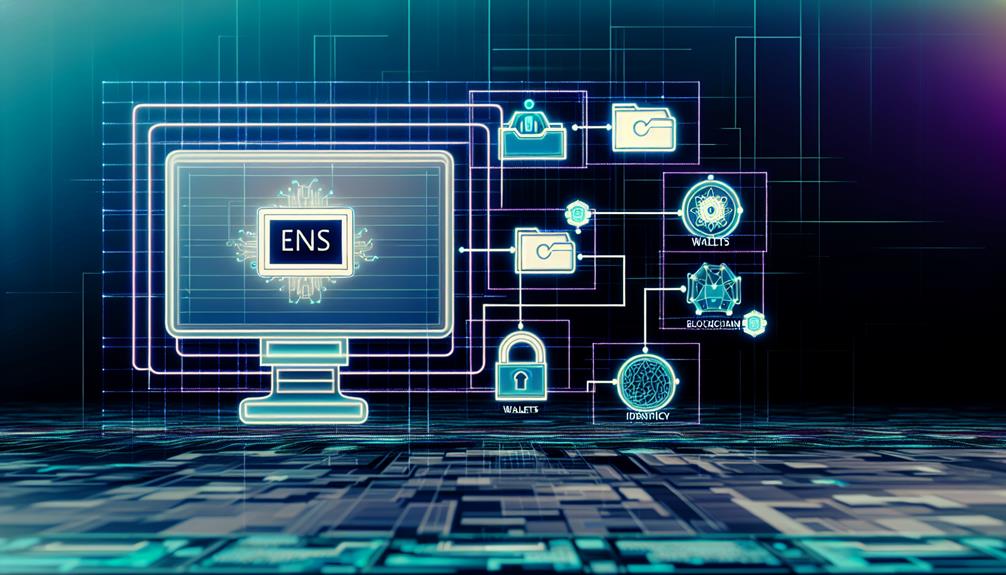

Moreover, the rise of blockchain technology, embraced by 40% of pharmaceutical companies, is enhancing supply chain transparency and combating counterfeit drugs, ensuring patient safety and trust in medications.

Additionally, the FDA's accelerated approval process, evidenced by an 87% increase in Breakthrough Therapy Designations from 2016 to 2020, facilitates faster access to innovative treatments.

Lastly, personalized medicine is emerging, with 60% of firms focusing on developing targeted therapies based on genetic profiles. This shift leads to more effective treatments tailored to individual patient needs, marking a notable evolution in the pharmaceutical landscape.

Current Challenges Facing Pharma Companies

Maneuvering the complex landscape of the pharmaceutical industry, companies in the USA encounter a range of significant challenges that hinder their progress.

A vital issue you face is the lack of alignment between C-suite executives and middle management. This disconnect often stalls essential digital transformation initiatives, preventing your organization from adapting to modern demands. Approximately 27% of middle managers point to ineffective change-agent leadership as a barrier to implementing necessary updates, which exacerbates the situation.

Additionally, as clients increasingly demand automation and digital strategies, your teams may struggle with the complexities these changes bring. This can lead to confusion and inefficiencies within your organization.

Compounding these challenges, a staggering 60-70% of the marketing content generated remains underutilized, resulting in wasted budgets and lost sales productivity.

With rising competition in the pharmaceutical sector, you must adapt your strategies to deliver more value at reduced costs.

Mid-market clients are particularly sensitive to cost-effectiveness amidst an oversaturated market, making it essential for you to refine your approach to overcome these hurdles and achieve sustainable growth.

Banking Domain Clients in USA

When you look at banking domain clients in the USA, it's clear that understanding their needs is essential for effective service delivery.

Consider these key aspects:

- Major banking institutions and their diverse clientele.

- The integration of technology in banking services.

- Methods clients use to guarantee cybersecurity.

- The impact of community banks on local markets.

Major Banking Institutions and Their Clients

Charting the landscape of major banking institutions in the USA reveals a complex relationship between banks and their diverse clientele. Institutions like JPMorgan Chase, Bank of America, and Wells Fargo collectively manage over $10 trillion in assets, catering to millions of individuals and businesses.

With approximately 95% of American adults holding bank accounts, it's clear that banks are integral to financial life.

In today's market, clients increasingly demand digital solutions. A significant 75% of consumers prefer online banking options, pushing banks to enhance digital services and user experiences. This shift highlights the need for institutions to guarantee they meet modern expectations.

However, maintaining client trust is essential. A recent survey showed that 76% of banking clients would switch banks for better customer service, emphasizing the importance of reliability in client relationships.

Additionally, banks face the burden of regulatory compliance, spending over $70 billion annually to adhere to various federal and state regulations, which can impact efficiency.

As a client, understanding these dynamics can help you navigate your banking choices and confirm you're getting the services you need right back from your institution.

Technology Integration in Banking Services

You'll notice that key trends in technology integration reveal a clear shift towards digital solutions in banking.

With a remarkable 90% adoption rate during the pandemic, customers now expect seamless experiences, prompting banks to invest heavily in AI and blockchain.

Understanding these trends is essential for enhancing customer satisfaction and retention in an increasingly competitive landscape.

What are the key trends in banking domain clients?

The landscape of banking is rapidly evolving, driven by significant technological integration that reshapes how clients interact with financial services.

Digital banking is now preferred by 75% of U.S. consumers, while fintech companies push traditional banks toward innovation.

As cybersecurity threats rise, 63% of institutions prioritize advanced security measures, ensuring client data protection and fostering trust in this competitive environment.

How do banking domain clients ensure security?

While maneuvering through the complexities of the banking domain, clients in the USA implement a robust array of security measures to protect their sensitive information. A primary defense mechanism is multi-factor authentication (MFA), which adds an extra layer of protection for online transactions and account access. This proactive approach markedly reduces the risk of unauthorized access.

Moreover, adhering to regulatory compliance, such as the Gramm-Leach-Bliley Act (GLBA), is essential. This mandates that banks prioritize customer data privacy and security, necessitating regular audits and risk assessments to identify vulnerabilities.

To safeguard sensitive financial data, advanced encryption technologies are employed, ensuring that information remains secure both in transit and at rest. These technologies help protect against data breaches and cyber threats that can jeopardize client trust.

Additionally, continuous monitoring of transactions for suspicious activities plays an important role in security. Many banks leverage artificial intelligence and machine learning algorithms to detect and prevent fraud in real-time.

Financial Domain Companies in USA

In exploring financial domain companies in the USA, you'll encounter a complex landscape shaped by regulations and consumer expectations.

Key aspects to evaluate include:

- Top financial services providers and their offerings.

- A market analysis revealing trends and challenges.

- User experience factors influencing customer loyalty.

- The impact of fintech innovations on traditional services.

Understanding these elements will equip you to navigate the financial services sector more effectively.

Top Financial Services Providers

Numerous financial services providers dominate the landscape in the USA, with giants like JPMorgan Chase, Bank of America, and Wells Fargo at the forefront. Collectively, these top financial services providers manage trillions in assets and serve millions of customers across the nation.

As of mid-2023, commercial banks held over $23 trillion in total assets, showcasing the immense scale of offerings available to consumers.

The rise of financial technology (fintech) firms, such as Square and Robinhood, is transforming the industry. These companies aren't just enhancing competition; they're also catering to younger demographics by introducing innovative services that disrupt traditional banking models.

Consequently, traditional providers are compelled to adapt, focusing on improving their digital banking services to meet the growing preference for online solutions. A 2022 American Bankers Association study revealed that 74% of consumers now favor digital banking services, emphasizing the urgent need for established banks to evolve.

In this highly regulated environment, agencies like the Securities and Exchange Commission (SEC) and the Federal Reserve work to maintain stability, creating a complex landscape for both consumers and providers to navigate.

Market Analysis of Financial Domains

Maneuvering the financial services landscape can be intimidating, especially with over 6,000 registered investment advisors and more than 10,000 credit unions competing for attention in the USA. This saturation creates a complex market where consumers often feel overwhelmed.

The U.S. financial technology sector is booming, with investments hitting around $46 billion in 2021, emphasizing a significant shift towards digital solutions. Yet, more than 40% of Americans say they can't afford to navigate these options effectively, lacking a clear understanding of financial products.

The asset management industry alone is valued at approximately $29 trillion, making it essential for you to differentiate between companies based on performance, fees, and service offerings.

The Securities and Exchange Commission (SEC) oversees over 25,000 investment companies, highlighting the need for compliance and transparency.

As you research, consider how much time you can invest in understanding these services. You may want to streamline your efforts by providing your email address to receive targeted information tailored to your needs.

Awareness of these market dynamics can empower you to make informed decisions in an otherwise confusing financial landscape.

User Experience in Financial Services

User experience (UX) plays a pivotal role in how consumers interact with financial services, shaping their overall satisfaction and engagement. If you think about it, 88% of consumers are less likely to come back to a website after a bad user experience. This statistic underscores the importance of intuitive design and functionality in financial platforms.

Years ago, many companies overlooked UX, but now, a staggering 70% of clients prefer digital channels for their banking needs, meaning you need a seamless online experience to attract and retain customers.

Moreover, companies that prioritize UX can enjoy a remarkable 400% return on investment, directly linking positive user experiences to improved business performance. However, 61% of consumers express frustration over complex online processes, indicating that simplifying interactions is essential for enhancing satisfaction.

Furthermore, effective UX fosters customer loyalty, with 50% of users stating that a well-designed interface would encourage them to explore new financial products and services. By focusing on user experience, financial service providers can't only meet customer expectations but also drive substantial growth in an increasingly competitive landscape.

Insurance Domain Clients in USA

When traversing the insurance market in the USA, you'll encounter a variety of challenges that can complicate your decision-making process.

Understanding key aspects of leading companies and current trends can empower you to make informed choices. Here are some critical points to reflect on:

- Major insurance providers and their target demographics.

- Current trends shaping the insurance sector.

- Expert insights on prevalent challenges in the insurance domain.

- The impact of technology on client experiences and transparency.

Leading Insurance Companies and Their Client Base

Maneuvering the landscape of leading insurance companies in the U.S. reveals a dynamic sector characterized by significant market players and a diverse client base. Major firms like State Farm, Allstate, and Berkshire Hathaway dominate the market, collectively holding over 30% of the total market share. This concentration highlights the competitive nature of the industry, where these companies cater to a wide array of clients.

As of 2023, nearly 80% of American households carry some form of insurance coverage, emphasizing the industry's essential role in financial security and risk management. The property and casualty segment, generating approximately $700 billion in direct premiums in 2022, reflects the high demand for coverage against unforeseen events.

Moreover, the insurance sector employs over 2.8 million people, signaling a robust job market with a strong demand for skilled professionals in underwriting, claims adjustment, and risk assessment.

With 63% of insurance companies prioritizing digital transformation initiatives, these firms are focused on enhancing customer experience while streamlining operations. This strategic shift not only serves existing clients but also positions them favorably for attracting new customers in a competitive environment.

Current Trends in the Insurance Sector

In today's rapidly evolving insurance landscape, digital transformation stands out as a key trend reshaping how companies engage with clients. With 85% of insurers investing in technology, the focus is on enhancing customer experience and streamlining operations.

Insurtech startups are also making waves, with funding surpassing $7 billion in 2021, indicating a strong push towards innovative solutions that cater to modern consumer needs.

The rise of artificial intelligence (AI) in underwriting and claims processing is another significant trend. This technology not only improves efficiency and accuracy but also reduces operational costs, making insurance more accessible and manageable for both companies and clients.

As customer expectations evolve, it's clear that 60% of consumers now prefer online interactions for insurance transactions. This shift has prompted insurers to enhance their digital platforms and service offerings, ensuring they meet these new demands.

Additionally, regulatory changes are impacting the landscape, with the National Association of Insurance Commissioners (NAIC) adapting guidelines to accommodate technological advancements while prioritizing consumer protection.

These trends collectively illustrate a dynamic insurance sector that's rapidly adapting to the digital age and shifting consumer preferences.

Expert Opinions on Insurance Domain Challenges

Nearly 60% of consumers in the U.S. are confused about their insurance coverage options, revealing a notable challenge within the industry. This confusion stems largely from the lack of clarity in policy offerings. Over 70% of clients express dissatisfaction with the complexity of claims processes, underscoring the urgent need for more straightforward communication and support from providers.

Experts suggest that enhanced digital tools could greatly improve client understanding and engagement; 65% of insurance agents agree on the potential benefits. However, a staggering 80% of insurance companies have yet to fully embrace automation, which contributes to inefficiencies and misunderstandings in client interactions.

Moreover, the average time you spend trying to understand your insurance policy exceeds 45 minutes, indicating a pressing need for simplification in policy language and better educational efforts.

As the industry grapples with these challenges, it's clear that addressing these issues through improved communication, technological advancements, and a focus on client education is vital for creating a more transparent and user-friendly insurance landscape. Ultimately, these changes could lead to greater client satisfaction and trust in the insurance domain.

Expanding Perspectives: Other Domain-Specific Companies

When you examine domain-specific companies across various industries, you'll find that many, like media, retail, and automotive, face unique challenges in reducing confusion.

Each sector employs specialized tools and platforms that streamline processes and enhance user experiences, showcasing innovative solutions tailored to their needs.

Media Domain Companies in USA

The media domain in the USA showcases a landscape shaped by both established giants and emerging players. Companies like Comcast, Disney, and AT&T dominate the television and film industries, controlling significant portions that influence content distribution and viewer access.

Their stronghold is challenged by the rise of streaming services, which have transformed how you consume media.

Here are some key trends in the media domain:

- Streaming Growth: Netflix, with over 230 million subscribers, exemplifies the shift toward on-demand content.

- Advertising Boom: The U.S. advertising market is projected to hit around $300 billion in 2023, emphasizing the need for effective digital marketing strategies.

- Cross-Platform Strategies: Companies like ViacomCBS and Warner Bros. Discovery are integrating their content across platforms to meet diverse consumer preferences.

- Niche Content Demand: Independent media companies and digital creators are thriving, fostering innovation and catering to specific audience interests.

Understanding these dynamics helps you navigate the complexities of the media landscape, revealing both challenges and exciting opportunities for growth.

Retail Domain Clients in USA

As the media landscape evolves, retail domain clients in the USA face unique challenges that impact their marketing effectiveness and overall business performance.

With over 60-70% of marketing content going unused, these companies experience lost sales productivity and wasted budgets. The disconnect between C-Suite executives and operational teams hinders effective implementation of digital strategies, creating significant barriers.

To navigate these complexities, consider the following strategies:

- Engage Early: Involve field representatives in the content creation process to enhance the relevance of marketing materials.

- Prioritize Compliance: Confirm that all marketing collateral aligns with industry regulations to protect sales teams from liability.

- Bridge the Gap: Foster communication between executives and operational teams to align digital strategies with on-the-ground realities.

- Innovate Constantly: Embrace digital transformation initiatives aimed at delivering greater value at reduced costs.

Automotive Domain Companies in USA

Maneuvering the complexities of the automotive domain in the USA requires understanding the dynamic landscape shaped by both traditional manufacturers and emerging players. The market is dominated by established giants like Ford, General Motors, and Tesla, which together accounted for about 70% of vehicle sales in 2022.

However, the shift toward sustainable transportation is evident as companies like Rivian and Lucid Motors gain traction in the electric vehicle sector.

As you explore this domain, consider these key aspects:

- Investment Trends: Over $100 billion is projected to be spent on electric vehicle and autonomous driving technologies by 2025.

- Tech Integration: Companies such as Google and Apple are venturing into the automotive space, focusing on advanced software and smart technologies.

- Shared Mobility Services: Uber and Lyft are redefining access to transportation, moving away from traditional vehicle ownership models.

- Sustainability Focus: The industry's pivot towards electric vehicles reflects a broader cultural shift towards environmentally friendly solutions.

Understanding these factors will help you navigate the evolving automotive landscape in the USA effectively.

Comparative Analysis of Various Domains

You may believe that all domain-specific companies operate under the same principles, but that's often not the case.

Misconceptions arise when one overlooks the unique strategies each industry employs to streamline customer interactions and strengthen brand loyalty.

What are the common misconceptions about domain-specific companies?

Domain-specific companies often face a range of misconceptions that can cloud public understanding of their role in the marketplace.

Many think they only serve niche markets, but they offer solutions that enhance efficiency across industries.

Additionally, they frequently collaborate with others, scale effectively, and provide customized products, debunking the notion that they target only large enterprises or deliver generic offerings.